Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Program

Importance of Affordable Home Insurance Policy

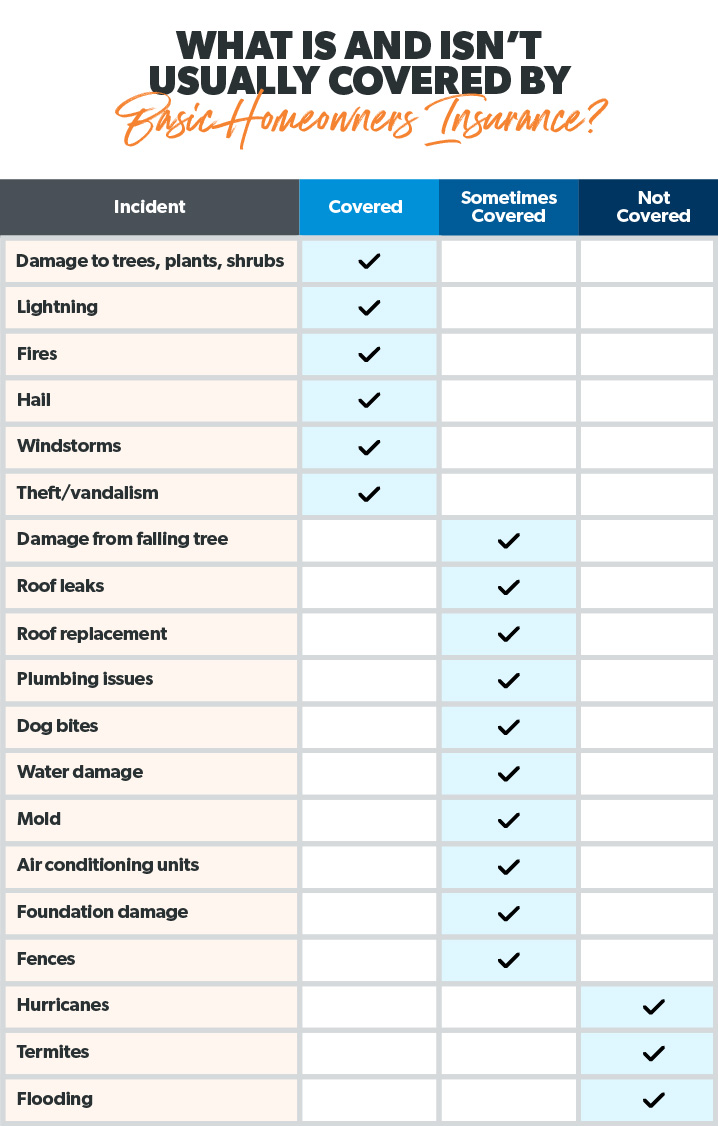

Safeguarding budget friendly home insurance coverage is vital for safeguarding one's residential property and financial wellness. Home insurance policy offers security versus various threats such as fire, theft, natural disasters, and individual liability. By having a comprehensive insurance coverage plan in position, house owners can relax assured that their most significant financial investment is protected in case of unpredicted situations.

Budget-friendly home insurance coverage not just offers financial safety but additionally provides assurance (San Diego Home Insurance). When faced with climbing home worths and building prices, having an affordable insurance plan ensures that home owners can quickly rebuild or fix their homes without encountering substantial economic concerns

Moreover, inexpensive home insurance can additionally cover individual valuables within the home, using repayment for items harmed or taken. This insurance coverage prolongs beyond the physical framework of the residence, protecting the materials that make a residence a home.

Coverage Options and Purviews

When it involves insurance coverage restrictions, it's important to comprehend the optimum amount your policy will certainly pay for each and every kind of insurance coverage. These limits can differ depending upon the policy and insurance company, so it's necessary to evaluate them very carefully to guarantee you have appropriate defense for your home and properties. By comprehending the coverage choices and limits of your home insurance coverage, you can make informed decisions to guard your home and liked ones successfully.

Aspects Influencing Insurance Policy Prices

Several variables dramatically affect the prices of home insurance coverage. The location of your home plays a crucial function in determining the insurance policy costs. Houses in areas vulnerable to natural calamities or with high crime prices usually have higher insurance prices as a result of increased risks. The age and problem of your home are likewise variables that insurance firms take into consideration. Older homes or properties in inadequate problem may be extra costly to insure as they are a lot more vulnerable to damages.

Moreover, the kind of coverage you choose directly influences the cost of your insurance plan. Deciding for additional coverage alternatives such as flooding insurance or quake coverage will certainly boost your premium.

Furthermore, your credit history, declares history, and the insurer you select can all affect the cost of your home insurance coverage. By considering these elements, you can make educated decisions to aid manage your insurance policy sets you back effectively.

Comparing Service Providers and quotes

Along with comparing quotes, it is important to examine the online reputation and financial security of the insurance discover here companies. Look for customer testimonials, rankings from independent firms, and any kind of background of grievances or regulative activities. A trustworthy insurance policy service provider ought to have a good record of without delay refining insurance claims and providing excellent client service.

Additionally, take into consideration the certain protection features offered by each supplier. Some insurers may supply fringe benefits such as identity theft defense, devices failure insurance coverage, or insurance coverage for high-value items. By carefully contrasting service providers and quotes, you can make an informed choice and select the home insurance policy plan that ideal meets your demands.

Tips for Reducing Home Insurance Coverage

After thoroughly contrasting companies and quotes to locate the most ideal insurance coverage for your requirements and spending plan, it is prudent to explore reliable approaches for conserving on home insurance. Numerous insurance companies provide discount rates if you acquire multiple plans from them, such as incorporating your home and vehicle insurance. On a More about the author regular basis assessing and upgrading your policy to reflect any type of adjustments in your home or scenarios can guarantee you are not paying for insurance coverage you no longer requirement, assisting you conserve money on your home insurance costs.

Verdict

In conclusion, guarding your home and enjoyed ones with cost effective home insurance policy is critical. Applying tips for saving on home insurance can also aid you safeguard the necessary protection for your home without breaking the financial institution.

By unwinding the complexities of home insurance coverage strategies and discovering functional techniques for safeguarding economical protection, you can ensure that your home and loved ones are well-protected.

Home insurance policy plans usually offer numerous coverage choices to secure your home and valuables - San Diego Home Insurance. By understanding the insurance coverage choices and restrictions of your home insurance policy, you can make educated decisions to safeguard your home and liked ones best site successfully

Regularly evaluating and upgrading your plan to mirror any changes in your home or circumstances can ensure you are not paying for coverage you no longer requirement, aiding you conserve cash on your home insurance premiums.

In conclusion, protecting your home and loved ones with budget-friendly home insurance policy is critical.

Comments on “The 7-Minute Rule for San Diego Home Insurance”